stock option tax calculator ireland

The country profiles are regularly reviewed and updated as needed. You buy back the.

Discover Your Potential Recruitment Startup Company Funding Options Visit Http Wearessg Com Setting Up A Recruitment Business

The value of the benefit is the market value of the shares at the date they were awarded.

. Emily made an Exercised Share Profit of 20000. Find the best spreads and short options Our Option Finder tool now supports selecting long or short options and debit or credit spreadsTry it out. The due date for filing a return is 31 March following the end of the tax year.

Sell Vests assumes you sell immediately upon vesting shares while Hold All assumes you. Hi everyone Im interested in starting to trade US stock options contracts. 343 Long Options - Tax at Date of Grant Where a share option is capable of being exercised.

The Stock Calculator uses the following basic formula. Companies Irish branches and agencies granting options including an Irish employer where the options are granted by a non resident parent company must complete returns of information Form RSS1 regarding the options. You purchase 10 Irish shares in January 2022 at a cost of 500 each.

Poor Mans Covered Call calculator addedPMCC Calculator. NS is the number of shares SP is the selling price per share BP is the buying price per share SC is the selling commission BC is the buying commission. To help you understand how stock options work lets walk through a simple example.

Well cover four topics in this post. See example below on how to calculate share profit. That means youve made 10 per share.

How to calculate the tax on share options. Depending on the type of stock options you are granted ISOs vs NSOs the stage of your company early vs late and your employment status new hire employed or departed there are a number of ways to reduce potential stock option taxesFrom taking advantage of specific IRS filings to simple tips and tricks you can potentially reduce your stock option exercise taxes. Let us introduce Emily who exercised her share options.

A share option is the right to buy a certain number of shares at a fixed price sometime in the future within a company. 4 HI hospital insurance or Medicare is 145 on all earned income. The relevant tax on share options is paid at 52.

Estimate how much your RSU value will increase per year. You and the company will need to sign a contract that outlines the. We do our best to keep the writing lively.

The Revenue website explains how the Capital Gains Tax works 33 for Irish and 40 for foreign properties if I understood correctly. Taxable benefit When a corporation agrees to sell or issue its shares to an employee or when a mutual fund trust grants options to an employee to acquire trust units the employee may. Cash Secured Put calculator addedCSP Calculator.

To use the RSU projection calculator walk through the following steps. So if you have 100 shares youll spend 2000 but receive a value of 3000. ISOs are tax free at exercise but you may be subject to Alternative Minimum Tax AMT.

On the date of exercise the fair market value of the stock was 25 per share which is reported in box 4 of. The most significant implication for employees is a 25000 benefit. Taxes for Non-Qualified Stock Options.

The average monthly net salary in the Republic of Ireland is around 3000 EUR with a minimum income of 177450 EUR per month. A stock option grants you the right to purchase a certain number of shares of stock at an established price. IV is now based on the stocks market.

Non-qualified Stock Options NSO or NQSO and Incentive Stock Options ISO. Decide on your strategy. These shares are a benefit in kind BIK.

Exercising your non-qualified stock options triggers a tax. The Global Tax Guide explains the taxation of equity awards in 43 countries. You paid 10 per share the exercise price which is reported in box 3 of Form 3921.

342 Short Options - Tax at Date of Grant Where a share option is not capable of being exercised more than seven years after the date on which it is granted ie. Support for Canadian MX options Read more. ISO tax treatment and benefits.

The wage base is 142800 in 2021 and 147000 in 2022. Lets say you got a grant price of 20 per share but when you exercise your stock option the stock is valued at 30 per share. Any income tax due on the exercise of the option is chargeable under self.

In most cases Incentive Stock Options provide more favorable tax. This form will report important dates and values needed to determine the correct amount of capital and ordinary income if applicable to be reported on your return. Stock option plan This plan allows the employee to purchase shares of the employers company or of a non-arms length company at a pre-determined price.

Ad Fidelity Has the Tools Education Experience To Enhance Your Business. This gives the total tax bill of 10400. Two types of stock option taxes to keep in mind.

Stock options restricted stock restricted stock units performance shares stock appreciation rights and employee stock purchase plans. Assuming the 40 tax rate applies the tax on the share options is 8000. There are two types of stock optionsIncentive Stock Options ISOs and Non-qualified Stock Options NSOsand they are treated very differently for tax purposes.

Qualified ESPPs known as Qualified Section 423 Plans to match the tax code have to follow IRS rules to receive favored treatment. This is calculated as follows. Suppose you get a job at a startup and as part of your compensation you receive stock options for 20000 shares of the companys stock.

The problem is that there is literally no information in the Internet about how this activity would be taxed in Ireland. An ESPP or Employee Stock Purchase Plan is an employer perk that allows employees to purchase a companys stock at a discount. Using the ESPP Tax and Return Calculator.

Understanding Stock Option Granting and Vesting. Enter the amount of your new grant - whether an offer grant or an annual refresh. This paper profit is immediately liable for income tax and must be paid over to the Revenue within 30 days of exercising the option.

Incentive Stock Option - After exercising an ISO you should receive from your employer a Form 3921 Exercise of an Incentive Stock Option Under Section 422 b. Input your current marginal tax rate on vesting RSUs. As a result you have to pay withholding tax at the time of exercise.

A short option no charge to income tax arises on the date that the right is granted. Cost of Shares10000 shares 1 10000. Exercising stock options and taxes.

Lets explore what it means to exercise stock options the taxes you may need to pay and the common times people exercise their options. NSOs are reported as ordinary income when you exercise your options. In October 2022 they are worth 800 each.

From 2011 onwards PRSI 4 and the USC 8 charges also apply. This places Ireland on the 8th place in the International Labour Organisation statistics for 2012 after United Kingdom but before France. Your payroll taxes on gains from exercising your NQ stock options will be 145 for Medicare only if and when your earned income exceeds the wage base for the given tax year.

Profit P SP NS - SC - BP NS BC Where. Each share has gained 300 You sell 4 shares for 3200 creating a capital gain of 1200 which is below the 1270 exemption from CGT. Example of Reduced Capital Gains Tax on Shares in Ireland.

Required ISO holding periods to receive. The taxation in Ireland is usually done at the source through a pay-as-you-earn PAYE system. There are two types of options.

Paylesstax 6 Easy Steps Paylesstax

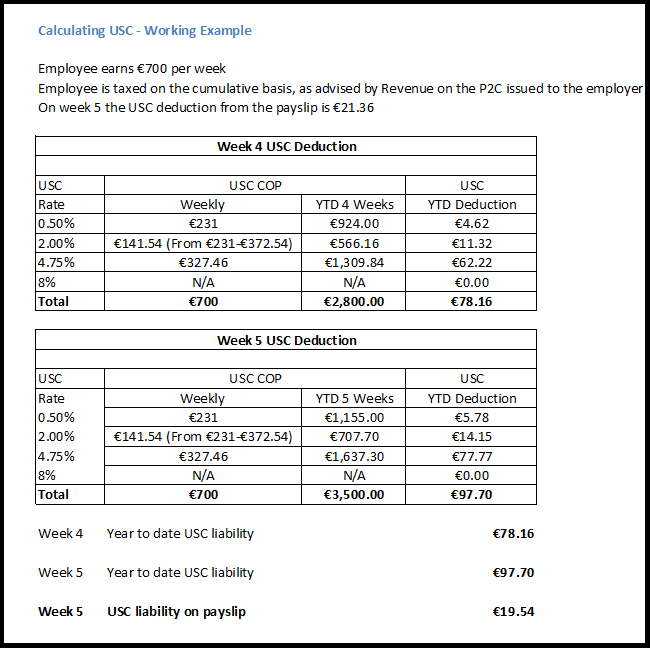

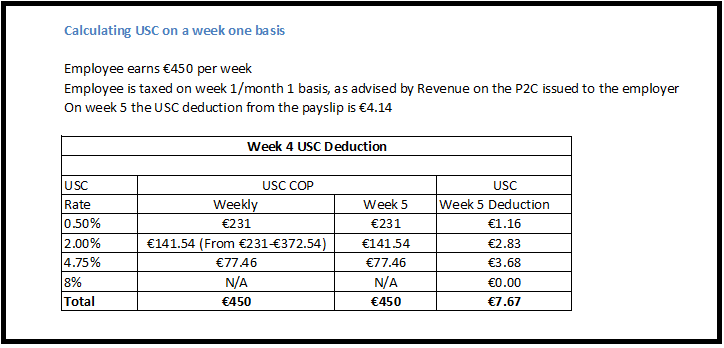

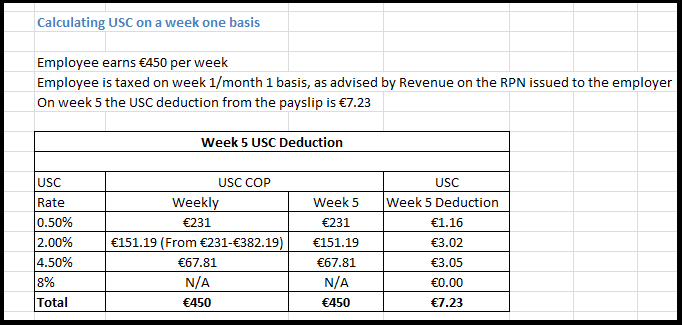

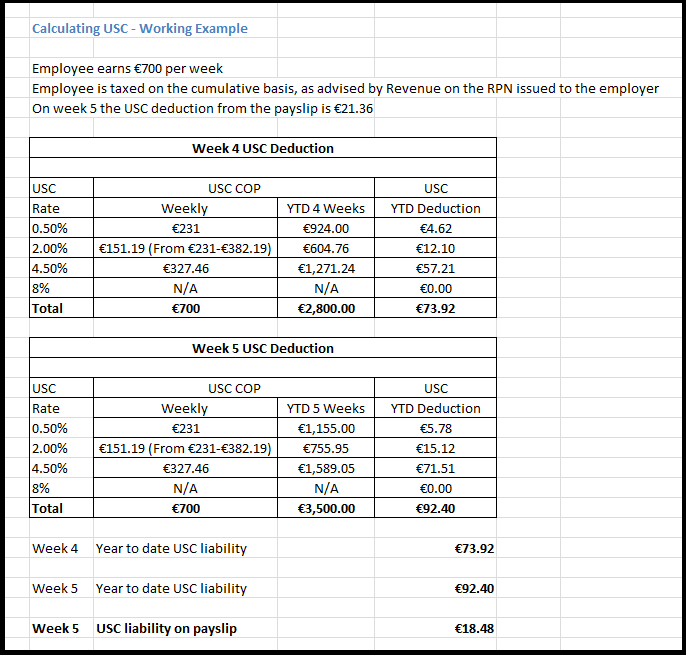

Universal Social Charge Calculations Brightpay Documentation

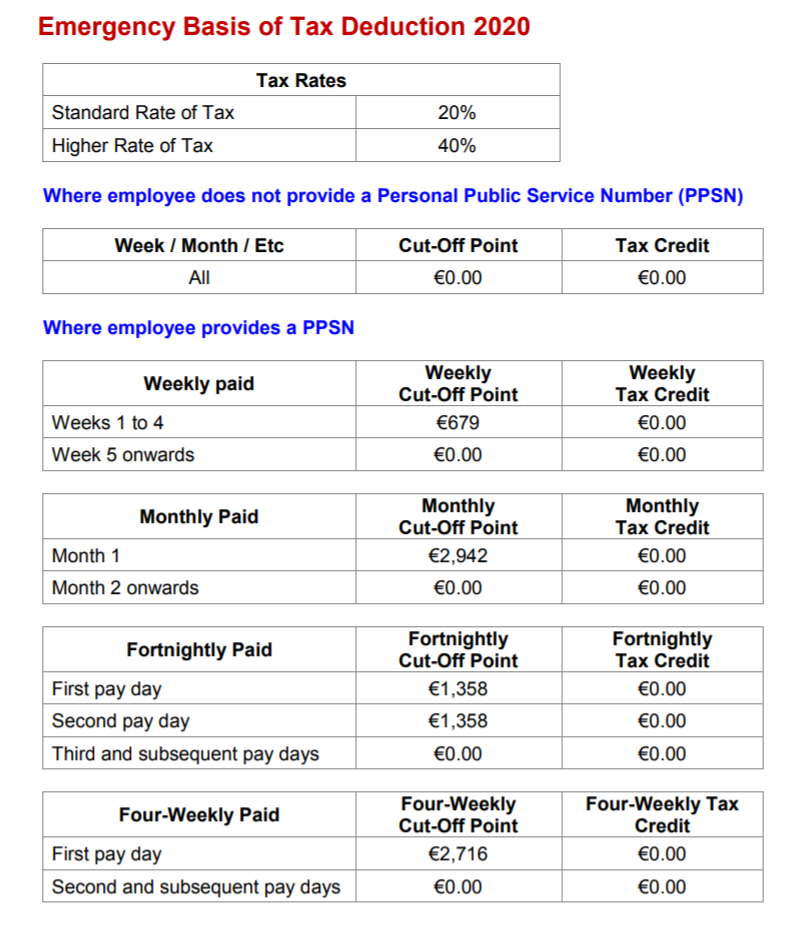

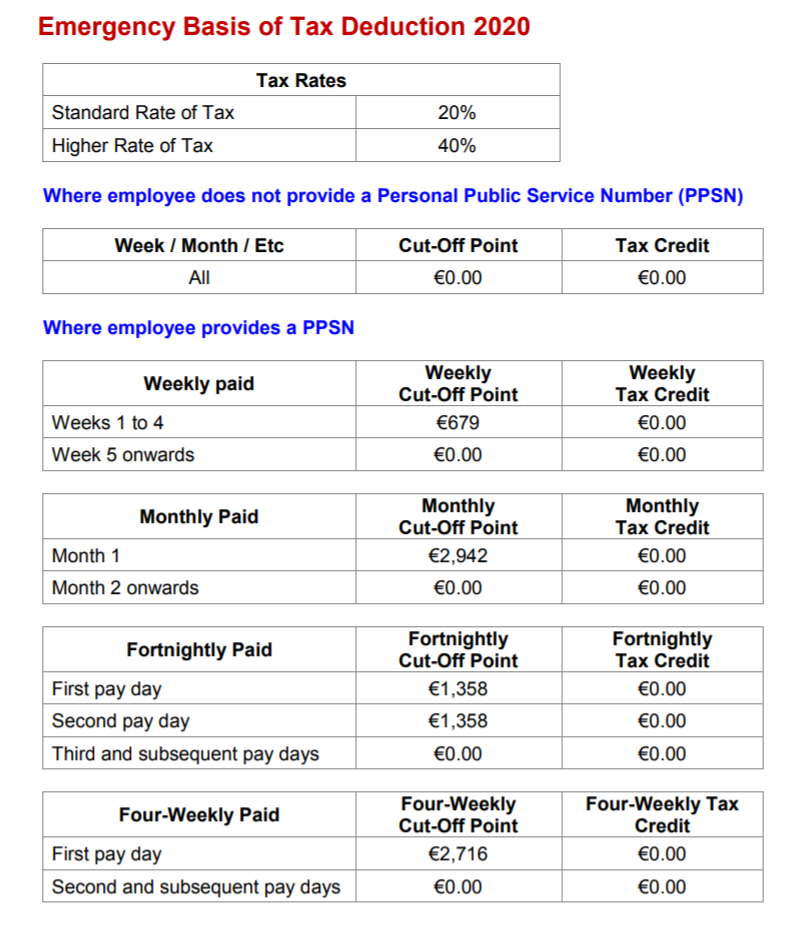

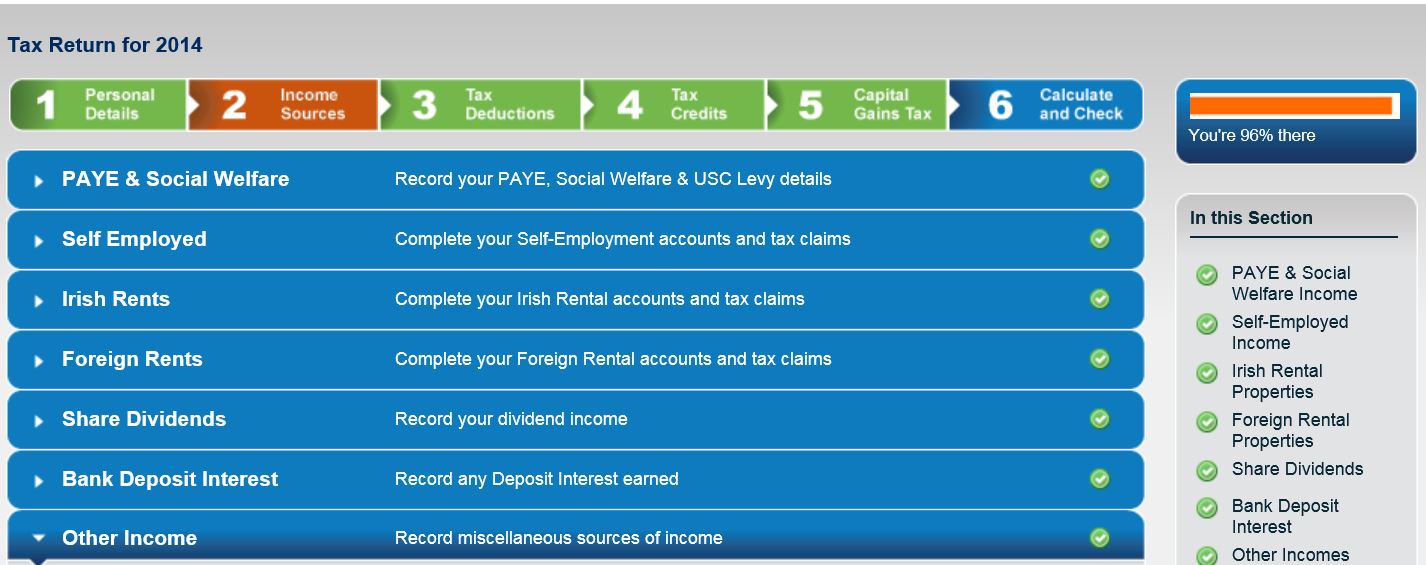

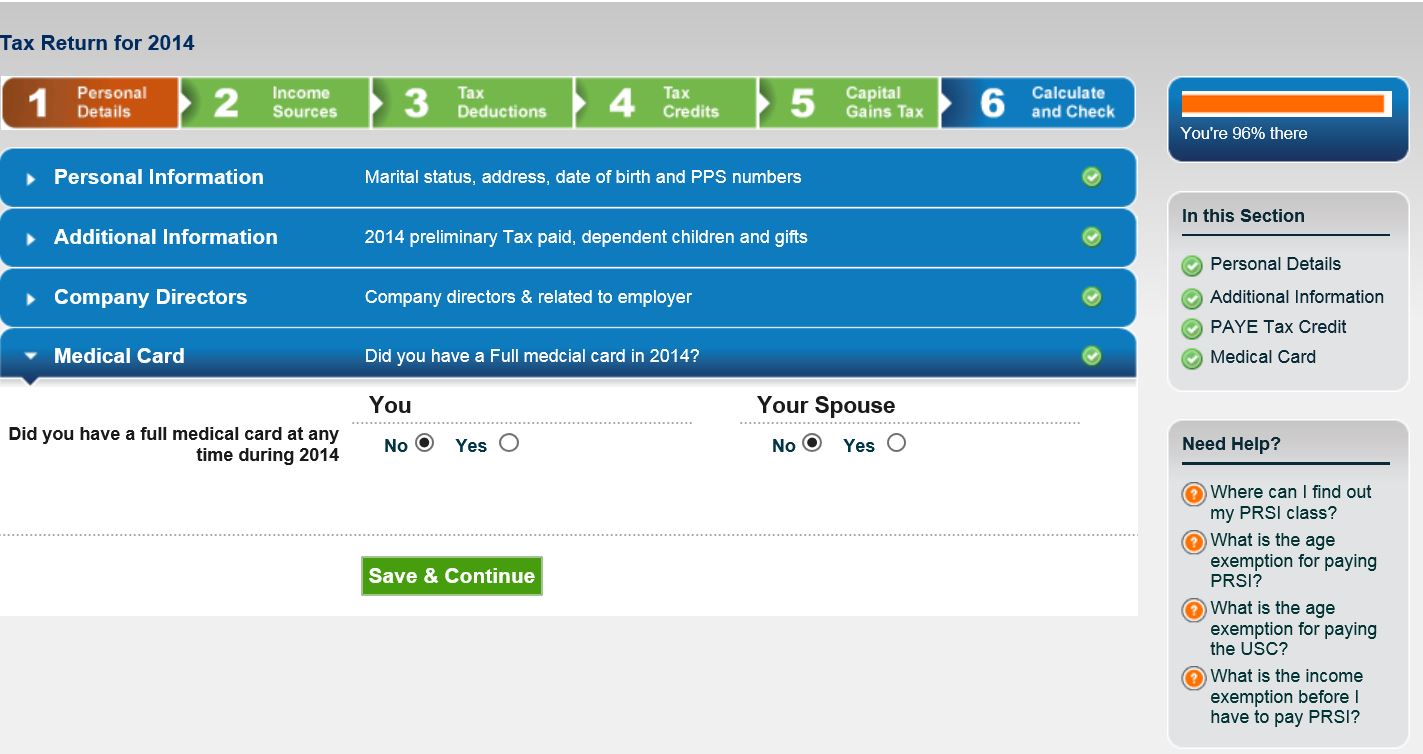

Paye Documentation Thesaurus Payroll Manager Ireland 2020

Easy Maths To Ensure You Put Enough Into Your Pension

Universal Social Charge Calculations Brightpay Documentation

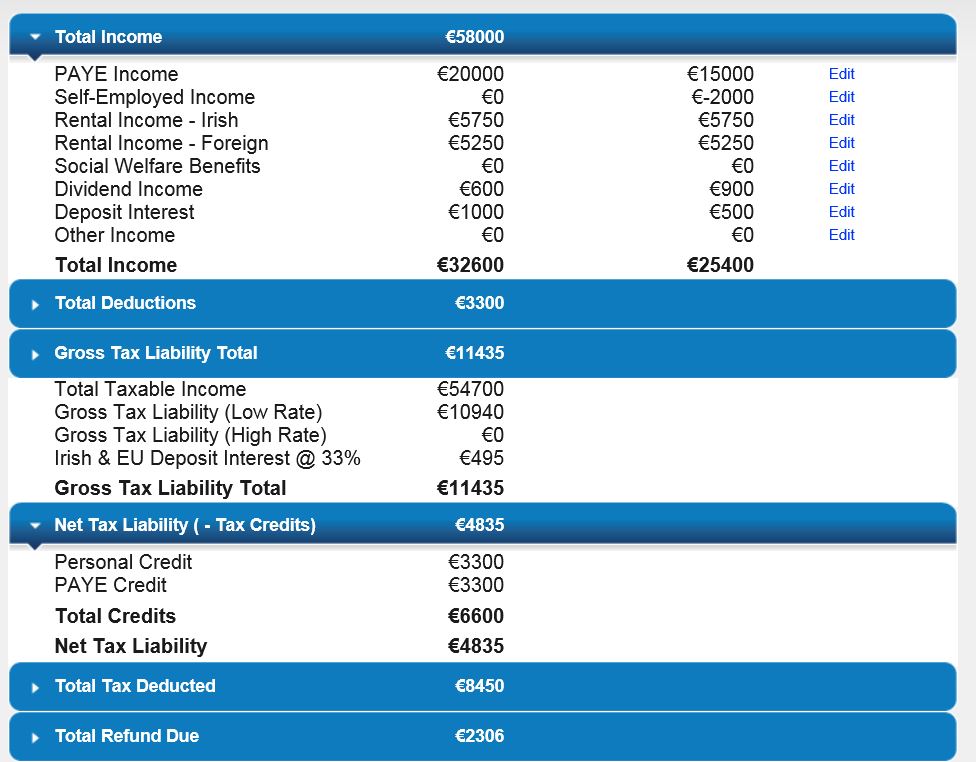

Paylesstax 6 Easy Steps Paylesstax

Paylesstax 6 Easy Steps Paylesstax

How To Minimise Tax On Your Investments Wealthwise Financial Update

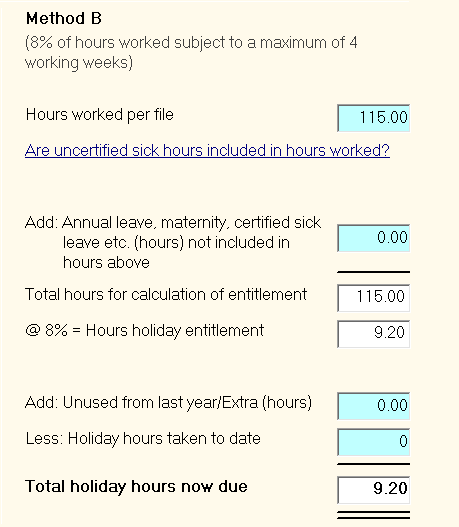

Holiday Calculator Documentation Thesaurus Payroll Manager Ireland 2020

Regional Power Grids Of Europe 1200 X 1275 Posted By U Flandardly To R Mapporn Sfw Power Grid Solar Solar Eclipse

Do You Pay Irish Taxes If Wages Are Paid Into An Overseas Account

Universal Social Charge Calculations Brightpay Documentation

Paylesstax 45 Minute Tax Return

Paylesstax Share Options Rtso1 Tax Calculator Paylesstax

Universal Social Charge Calculations Brightpay Documentation

Debt Arrangement Scheme Scottish Das Mortgage Repayment Calculator Debt Problem Repayment

Social Welfare Ireland How To Claim Tax Rebates In 2022 Dublin Live

Holiday Calculator Documentation Thesaurus Payroll Manager Ireland 2020