estate tax exemption 2022 proposal

Reducing the estate and gift tax exemption to 6020000 effective January 1 2022. The tax reform proposals announced by the Administration in April and the General Explanations of the Administrations Fiscal Year 2022 Revenue Proposals published.

Estate Planning For The Savvy Client What You Need To Know Before You Meet With Your Lawyer Savvy Client In 2022 Estate Planning How To Plan Estate Planning Attorney

The Monticello City Council approved a resolution to oppose Senate Bill 378 which is designed to tweak the assessment value of a businesss personal property increasing the acquisition cost threshold for personal property tax exemption from 80000 to 250000.

. The exemption will increase with inflation to approximately 12060000 per person in 2022. Bakers estate tax proposal carries a price tag of 231 million which. The current 11700000 federal estate tax exemption amount would drop to 5 million adjusted for inflation as of January 1 2022.

No Changes to the Current Gift and Estate Exemption Provisions Until 2025. Katie Lannan State House News Service. Some proposals would have reduced the estate and gift tax exemption amount from its current level of 1206 million per taxpayer to 35 685 million per taxpayer depending on the source.

We Win Cases Free Evaluation Get Started. 24 rows On November 10 2021 the IRS announced that the 2022 transfer tax exemption amount is. Here is what you need to know about the proposal.

The good news is that the once-in-a-lifetime estate and gift tax exemption of 10 million as adjusted for inflation presently 117 million per taxpayer or 234 million for married couples will be intact through the end of. The Biden Administration has proposed significant changes to the income tax system. Bureau of Labor Statistics Consumer Price Index.

As of 2021 the exemption stands at 11700000 per person and is expected to increase each year based upon the US. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. Effective January 1 2022 the 2021 federal estate and gift tax 11700000 lifetime exclusion is increased to 12060000.

Previously this reduction was not scheduled to take place until January 1 2026. This Alert focuses on the changes that directly impact common estate planning strategies. From Fisher Investments 40 years managing money and helping thousands of families.

Federal Estate Tax Even though you wont owe estate tax to the state of California there is still the federal estate tax to consider. Decrease of Valuable Estate and Gift Tax Exemptions Effective January 1 2022 Time is now of the essence for utilizing gift and estate tax exemptions. 8 hours agoFebruary 23 2022.

The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million indexed for inflation to roughly 62 million as of January 1 2022. Estate and Gift Tax Exclusion Amount. The new exemption amount would be 5 million indexed for inflation dating back to 2010.

The proposal would roll back the giftestate and GST lifetime exemptions to one-half the current levels set in 2017 effective January 1 2022. Lower Estate Tax Exemption Currently the allowed estate and gift threshold is 10000000 adjusted for inflation. If you have an estate of 10000000 and decide to keep it in your possession past the end of the year 5000000 of your assets will be subject to estate tax.

If that person passes away in 2022 when the Lifetime Exemption is decreased to 6000000 then 4700000 of their 10000000 taxable estate would be taxed at the 40 estate tax rate resulting in 1880000 of estate tax due. The current 2021 gift and estate tax exemption is 117 million for each US. The federal gift tax has yearly exemption of 15000 per recipient per year for 2021 going up to 16000 in 2022.

Under current law the estate tax on a net taxable estate of 11700000 will be zero. Under current law the existing 10 million exemption would revert back to the 5 million exemption amount on January 1 2026. Monticello opposes proposed tax relief bill threatens city operating budget.

The exemption is unlimited on bequests to a surviving spouse. Ad You Have Rights. As of January 1 2022 that will be cut in half.

Charlie Baker testified about his tax break proposals including changes to the estate tax during a Joint Committee on Revenue hearing at the Massachusetts State House on Tuesday Feb. The 117M per person gift and estate tax exemption will remain in place and will be increased annually for inflation until its already scheduled to sunset at the end of 2025. July 13 2021.

New legislation may accelerate the sunset provision ie roll-back currently scheduled to cut. The official estate and gift tax exemption climbs to 1206 million per individual for 2022 deaths up from 117 million in 2021 according to new Internal Revenue Service inflation-adjusted. 20 hours agoBakers estate tax proposal carries a price tag of 231 million which Uyterhoeven contrasted noted pales in comparison to the 77 million pitched in relief for renters.

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Estate Planning Can Be Helpful Regardless Of Your Income Level Do You Agree With This Assetprotection Est In 2022 Estate Planning Tax Questions Succession Planning

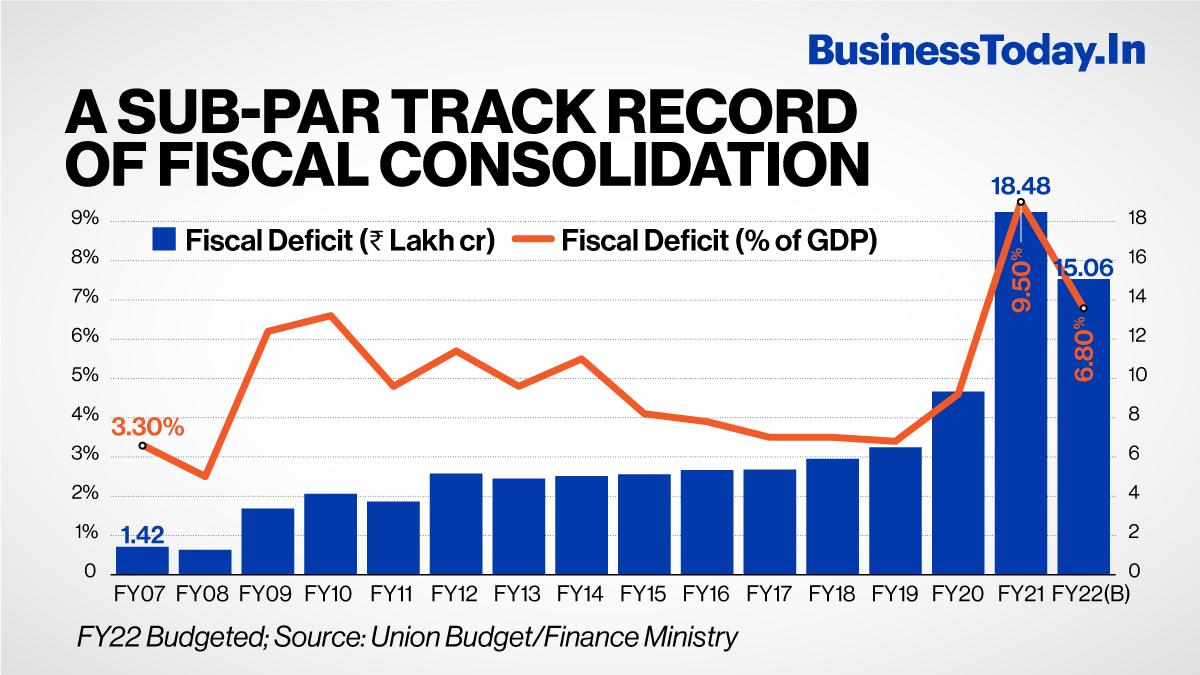

Budget 2022 A Sub Par Track Record Of Fiscal Consolidation Will It Change Businesstoday

Top Features Of Pension Plan Pension Plan How To Plan Pensions

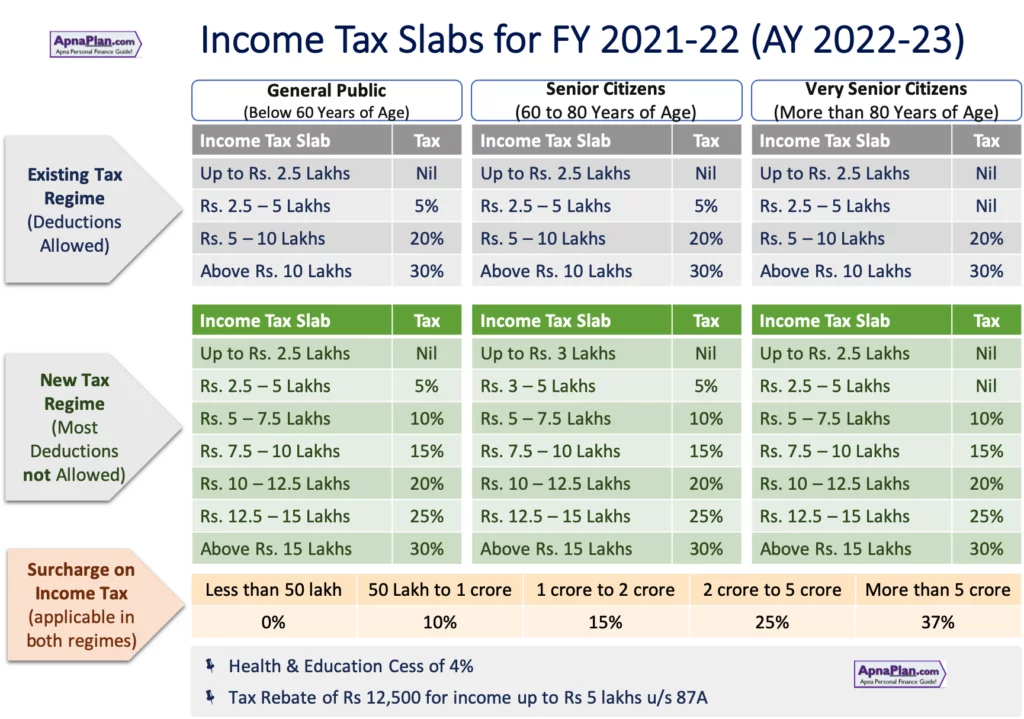

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas

Estate Planning Strategies To Safeguard Assets And Avoid Taxes Business Insider Estate Planning Business Insider Strategies

Old And New Tax Regime Rates For Ay 2022 23

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

2022 Q1 Marketing Checklist Marketing Checklist Marketing Plan How To Plan

2022 Tax Inflation Adjustments Released By Irs

Homestead Exemption Explained And New Rules For 2022 In California In 2022 Estate Planning How To Plan Protecting Your Home

Get Tsp Retirement Calculator Pictures In 2021 Retirement Calculator Retirement Planner Retirement Benefits

Would You Do Anything To Protect Your Family Attorneyatlaw Estateplanninglawyer Will In 2022 Estate Planning Family Plan How To Plan

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Over 1700 Unauthorized Colonies In Delhi In 2022 Income Tax Business Structure Investing

Check Out Our Fun Fact Of The Day According To The Cooperative Society Many People Were Not Prepared To Take On This In 2022 Estate Planning Family Plan How To Plan

Business Proposal Template Powerpoint Sample Business Proposal With Business Plan Business Plan Presentation Business Plan Template Business Plan Template Free

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More